SAMSUNG Ads Decoding Fast Software

Introduction

Free Ad-Supported Streaming TV (FAST) has quickly taken hold as an important viewing option for streaming TV viewers. As one of the fastest-growing viewing options, FAST is attracting new talent, content, and distributors. With consumers and content moving to FAST, it has become a hot topic of discussion among advertisers, but there are still as many questions as answers.

This paper will offer specific details about FAST to answer many of the biggest questions including: What is FAST, How big is FAST, What Content is on FAST, and What does the future hold for FAST? Our goal is to help media buyers make informed decisions about why and how FAST should be added to media plans.

FAST: A Rapidly Transforming Landscape

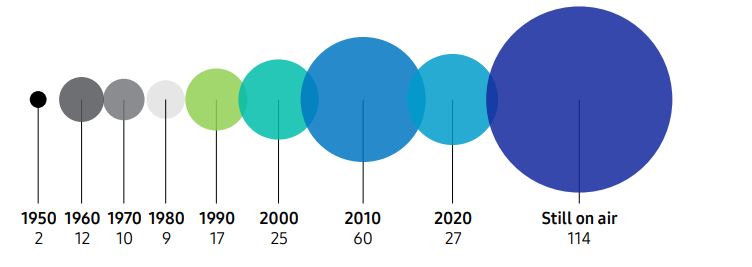

The landscape of FAST is undergoing a transformative shift, challenging the prevailing misconception that it serves as a repository for older, less valuable content. Across the hundreds of FAST channels offering single-title content, more than one-third are programs that are still in production, and 46% are programs that first aired in 2020. FAST encompasses a diverse set of programming genres including TV dramas, sitcoms, theatrical movies, music & music videos, news & opinion, and sports.

News has emerged as a rapidly growing genre expanding into live broadcasts of national and local newscasts. Sports channels are embracing both niche and major league offerings. And as the audiences watching longtail over-the-air and pay TV networks shrink, we’re seeing a surge in live stream simulcasts from TV networks, adding a new dimension to FAST’s profile.

What is FAST?

FAST stands for Free Ad-Supported Streaming Television. It refers to services that primarily provide free linear streaming channels that viewers join in progress. Cord-cutting, rising costs for streaming services, frustration with the process of finding on-demand content, and out-of-the-box built-in services have all driven consumer adoption of FAST. Viewers are looking for quality entertainment at lower costs; FAST offers lean-back, no-cost entertainment with a curated set of channels across a variety of formats and program genres, from TV programs to movies and original content.

FAST services include Tubi, Pluto TV, and Samsung TV Plus among others. An in-depth, updated look at all the services from FASTMaster, Gavin Bridge, is available at: https://fastmaster.substack.com

How Does FAST Work?

From the consumer perspective, FAST is increasingly becoming TV. A key reason why FAST feels like traditional TV is that it follows the same structure. Channels are linearly scheduled with content via a programmer or scheduler, have regular ad breaks, and are joined in progress when the viewer accesses it1. At the same time, linear TV and FAST are coming together in different ways. FAST services like Samsung TV Plus are incorporating live streams of over-the-air channels alongside their FAST channels;

Virtual MVPDs like YouTube TV and Fubo are including FAST channels within their linear lineups, and distributors like Comcast are incorporating Xumo FAST channels into their X1 set-top box and channel guide. Monetization of FAST comes via advertising. In general, FAST ad breaks are shorter than those of broadcast and cable TV2 , which makes the format a better consumer experience and attractive to users. Advertisements look the same, with the same major brands advertising in FAST, using the same ad creatives they use on linear and ad-supported streaming.

How Big is FAST?

FAST continues to grow in the United States. From a usage standpoint, multiple sources have demonstrated that penetration and time spent with FAST continue to grow. HUB Entertainment Research notes that 57% of U.S. HHs3 use FAST. TVision Insights reports that 12% of time spent with CTV in the U.S. is with FAST apps4. And at Samsung, where our FAST app, TV Plus, is a top 5 app by users and time spent, we recently announced that FAST consumption has grown by nearly 60% in the past year. To answer the important questions advertisers have about FAST, we will look at two key dimensions of growth – the number of major companies offering FAST services, and the number of available channels on these platforms.

FAST Services

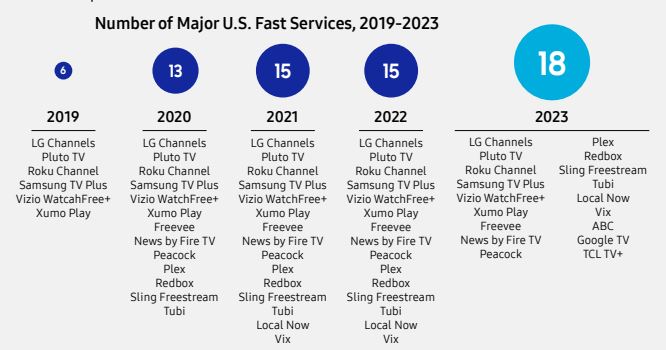

The number of major FAST services continues to grow in 2023, with ABC, Google, and TCL launching new services to sit alongside 16 other services from entertainment and technology companies. Since 2019, 12 new major services have launched, tripling the FAST market, a testament to the promise that FAST offers.

What Content is on FAST?

The number of FAST channels available across the FAST services has seen significant growth every year as more content companies and brands enter the space. As of November 2023, there are over 1,900 individual FAST channels in the U.S. available on one or more major services, an increase of 214% from November 2020.

What Programming is On FAST?

Content availability is the primary driver of consumer adoption of any TV service. Yet, in the advertising business, there seems to be an assumption that programming on FAST is low-engagement content. As the growth in consumer adoption suggests, this is not the case. FAST apps on the Samsung platform have an average engagement index score of 132 compared to all apps and linear TV channels. While library content is popular on FASTs, the same is true for what airs on linear TV networks and makes up a large swathe of the content on SVOD services.

The success of Suits on Netflix occupied much of the trade press’ focus on SVOD during 2023. Across linear networks and streaming services, shows like Law & Order, Friends, The Big Bang Theory, and others are attracting audiences. FAST programming is a myriad of content types and genres including entertainment, news, music, sports, and live broadcasts. This is likely to grow in the future. The expansion of news, particularly local news, has been an inflection point for FAST.

News continues to draw viewers to Pay-TV and its availability on FAST makes cutting the cord easier for Pay-TV stalwarts. Live, local news also opens the door for further growth in live content on FAST and has important implications for sporting events moving to FAST. FAST content is available across multiple languages. While the majority of FAST Channels broadcast in English, 14.5% of channels are Spanish-language and the remaining 6.5% are in other languages.

FAST Formats

Several lenses help detail the content that is available on FAST. The first of these is the format.

Five main formats within FAST

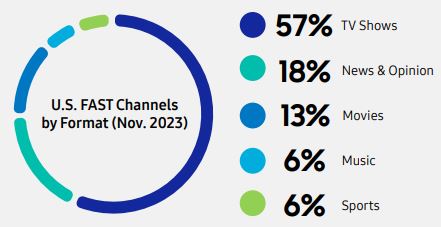

Current and classic TV shows, including scripted and reality programs, account for more than half of all FAST channels available across major FAST services in the U.S., a fact that makes sense considering the volume of available TV programming. The next largest format is News & Opinion, which makes up around one in five channels, followed by Movies. Music and Sports each account for just over 1 in 20 FAST channels.

FAST Genres

The second way to assess what’s available on FAST is by genre within each format. A genre analysis demonstrates the rich variety of content that’s available to viewers.

TV Shows

When breaking down the available genres within the TV Series format, it’s apparent how many content companies have turned to FAST, not just in scale (with 1,087 total channels) but the breadth of the genre. The most popular genres to have FAST channels are reality (120), drama (115), documentaries (97), kids (83), channels featuring mixed genres (78) and comedy (73).

Movies

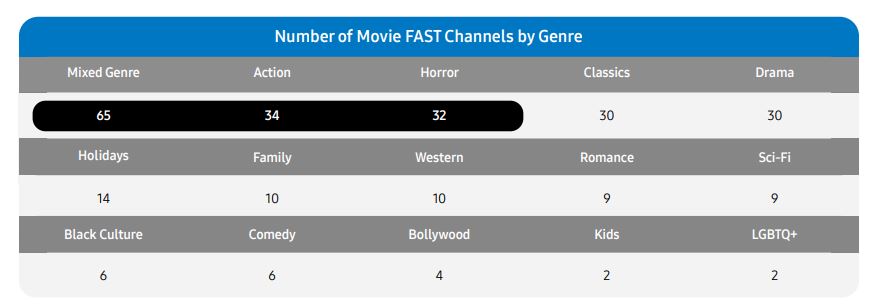

When it comes to movie channels available on FAST, the most popular channel type is one that features multiple genres (such as The Movie Hub or MovieSphere by Lionsgate). Then it’s a four-way split for movie channels based on the following themes: action, classic movies, drama, and horror. Movies are a format that reflects cultural events like Valentine’s Day, Halloween, and the Holidays, with holiday-themed movie channels illustrating this growth from 3 channels in September 2023 to 14 in November. Interestingly, while kids’ content on FAST has been embraced by the TV show side, for movies there are just two dedicated channels.

News

News has grown into one of FAST’s hottest areas. It has seen an explosion in the number of channels available with 333 available as of November 2023. News channels have evolved from being loops of evergreen content and are now either high-quality national news channels–indistinguishable from broadcast and cable news outlets and produced by newsrooms from the likes of ABC News, CNN, and Fox News—or feeds from local news channels, which now account for 69% of all FAST news channels.

A key driver for both national and local news is how many of these stations feature a live component for part of the day. Many local stations simulcast live with the TV broadcast, with some creating additional detailed reporting as a FAST exclusive. As news coverage of the 2024 election ramps up, we expect to see viewers turn to both local and national FAST channels resulting in increased news consumption on FAST.

Focus on Local News

The number of local news channels embracing FAST across major services has exploded in recent years as channels showed a degree of savviness in pivoting to embrace audiences wherever they are watching. This also helps to ensure that local stations maintain their relevancy in the digital era and maximize their reach. Local news on FAST has gone from 3 local stations available on tracked services in September 2020 to over 230 in November 2023. With Spanish markets in the U.S. also entering the space, local news on FAST shows no sign of slowing any time soon.

More Than Reruns

A common misconception about FAST is that the majority of content is mostly reruns of old content. Analysis conducted of single-IP channels in the U.S. illustrates how much of a misconception this is. As of September 2023, of the 340 single-IP channels, 114 (just over 33%) were based on shows or franchises that were still making new content. As curious consumers sample FAST and scroll through the available channels, seeing channels based on shows like Survivor, Law & Order, or Hell’s Kitchen can give FAST an instant credibility boost and add to the feeling that it is just the same as what viewers think of as “TV”.

FAST Exclusives & Originals

In addition to syndicated content that aired elsewhere before appearing on FAST, services are also offering content exclusive to FAST and original programming. National news channels like NBC News Now, ABC News Live, and CBS News all produce original shows for FAST, as does Fox Weather, with several local stations creating FAST-only content. Shows distributed on FAST from Tastemade (Struggle Meals) and Freevee (Judy Justice) have won daytime Emmys, beating out competition from broadcast and cable networks. Channels from celebrities have created originals, like LOL! Network’s Cold As Balls and Maximum Effort Channel’s Bedtime Stories with Ryan.

This report already referenced Vevo Pop’s original series Extended Play; Women’s Sports Network produces the FAST original game show Game On; and Roku Channel is the exclusive home for live editions of The Rich Eisen Show7 as well as airing originals from celebrities like Martha Stewart8 and Emeril Lagasse9. In addition, channels like FailArmy, Revolt Mixtape, Fox Soul, KIN, Tastemade, and FilmRise’s channels such as FilmRise Black TV all create original content on FAST10.

Other channels are using FAST as part of a modern distribution strategy. MotorTrend released episodes of Super Turbo Story Time on MotorTrend FAST TV shortly after airing on their cable channel. ElectricNow, the FAST channel for Electric Entertainment, aired the first two episodes of the new Syfy Channel show The Ark before the linear debut and helped to drive the strong viewership that the series saw in its cable premiere.

Media’s Increased Involvement

A key evolution that will continue into 2025 will be the embrace of big media brands running FAST channels. It’s likely we will see more announcements like NBCUniversal’s in the summer of 2023, that they will be releasing 50 new FAST channels, as media companies mine their content libraries to create both genre-curated channels like Universal Crime and many more single-IP channels like Lassie, E! Keeping Up, or Conan O’Brien TV.

Each FAST channel expands a media brand’s reach and advertising inventory—a strong incentive. In addition, we will see more channels launched by celebrities, featuring content that the celebrities themselves would watch. (There is strong potential within this area for programming blocks from content providers like Vevo for elements like “Mike’s favorite songs from the 80s.”).

Non-Traditional Media in FAST

The embrace of social media influencers in FAST will also continue. The likes of channels by creators and brands like Preston & Brianna, Mythical, Mr. Beast, and Unspeakable are just the beginning as Gen Z and Alpha discover the format. This influx of recognizable content will have a positive effect on smaller independent channels. Many of today’s independent channels will not be around in 2025. Some will merge to create a mega-version of a particular genre—think an MMA channel based on four or five existing ones—and others will find new life as content licensors to larger channels that require fresh content in their schedules.

FAST and TV Will Become the Same for Consumers

The distinction between broadcast and cable TV networks and FAST channels will continue to blur. More MVPDs and virtual MVPDs will include FAST channels in their lineups as they become indistinguishable from traditional TV channels. The continued invasion of FAST by TV brands will also add to this blurring from a consumer perspective—if TV channels are on FAST, surely then FAST must be TV? We may start to see the traditional idea of a network encompassing FAST channels. We should also be on the lookout for a new term arising from consumers themselves.

The Battle for Control

The entry point for watching FAST will become increasingly important. Companies that control distribution—TV sets, video game consoles, set-top boxes, and other connected devices—and own a FAST service powering it—will become the de facto entry point for FAST channels.

FAST by 2030

FAST in 2030 will be radically different from that in 2025, much as 2025’s landscape will be alien to 2020’s. Key to this will be AI, the convergence of TV with FAST and freemium upsells. Within the next few years, many FAST services will offer 1,000 channels or more. AI will make that possible, ensuring that users only see the most relevant 200-300 in a grid, offering unparalleled choice and options to the consumer. Cable networks will continue to run brand extensions for older content, but in a bid to reach the maximum number of viewers, all broadcast networks will follow Ion’s trendsetting move to FAST and offer live streams of their own via FAST.

Advertisers will embrace this as it will offer them the greatest possible reach to their target audiences. TV tentpoles—major sporting events and awards shows— will simulcast on FAST. This will begin with events like The Emmys and the Champions League final but will culminate with The Oscars and the Super Bowl as networks look to deliver the greatest number of viewers. Finally, the role of FAST as an upsell for premium subscription services will continue. This will take two forms.

The first will be an offering with episodes available on a linear basis for free, but available to be watched on-demand for a fee. The second will be an extension of what we already see for services like BritBox, Paramount+, and Peacock. By 2030, all major SVODs, including Apple TV+, Disney+, and Netflix, will have FAST channels featuring relevant library content designed to entice people to subscribe and keep them from churning.

Methodology & About

Methodology:

Analysis in this report was conducted across the available services and channels collected in the FASTMaster database. The services included in each year’s analysis were as follows:

- 2020: Freevee (as IMDb TV), Peacock, Plex, Pluto TV, Redbox Live TV, Roku Channel, Samsung TV Plus, STIRR, Xumo Play

- 2021: Freevee, LG Channels, Peacock, Plex, Pluto TV, Redbox Live TV, Roku Channel, Samsung TV Plus, Sling Freestream, STIRR, Tubi, Vix (as Prende TV), Vizio WatchFree+, Xumo Play

- 2022: Freevee, LG Channels, Local Now, Peacock, Plex, Pluto TV, Redbox Live TV, Roku Channel, Samsung TV Plus, Sling Freestream, STIRR, Tubi, Vix, Vizio WatchFree+, Xumo Play

- 2023: ABC, Freevee, Google TV, LG Channels, Local Now, Peacock, Plex, Pluto TV, Redbox Live TV, Roku Channel, Samsung TV Plus, Sling Freestream, STIRR, Tubi, Vix, Vizio WatchFree+, Xumo Play

About FASTMaster & CRG Global

Formerly the FAST industry’s foremost chronicler at Variety Intelligence System, Gavin Bridge is the Vice President of Media Research at CRG Global, a boutique market research firm. He has kept the FASTMaster database since October 2019 and an industry blog—The FASTMaster—since November 2021. Gavin is a thought leader in FAST and frequently consults with brands and attends international conferences in countries such as Australia, South Korea Canada, Spain, and France to share his knowledge and ideas. Learn more about CRG Global at www.crgglobalinc.com and read The FASTMaster at fastmaster.substack.com.

FOR MORE MANUALS BY SAMSUNG, VISIT MANUALSDOCK